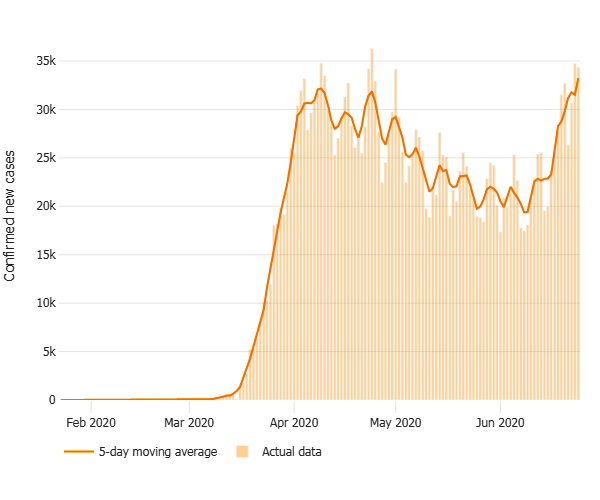

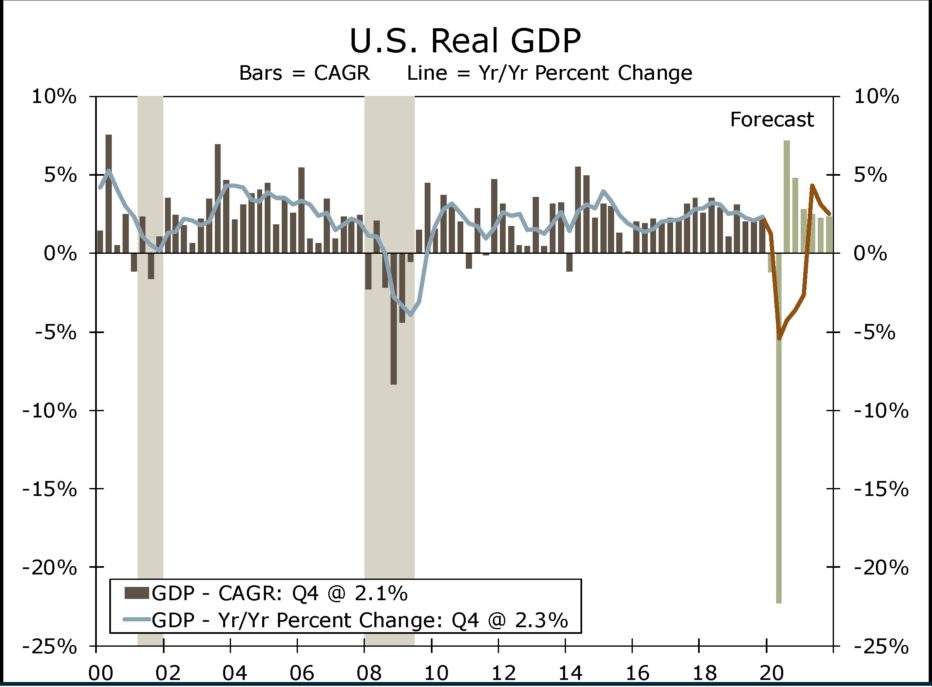

Make no mistake. When 4.8 million Americans go back to work in one month it’s good news. Today’s Employment Situation Summary from the Census Bureau showed that about 30% of the workers laid off during the March-April COVID-19 mitigation have been re-hired. Unemployment fell to 11.1%. That report comes on the heels of private payroll report for June from processor ADP, which showed 2.4 million jobs being recovered in the private sector last month. The Census Bureau rolling chart is one that is unlike any other in my lifetime.

So, what’s the bad news? First, the report on first-time unemployment claims for the week of June 20 was released this morning and it showed that claims increased last week. Another 1.428 million people filed for unemployment and the number of people continuing to claim unemployment comp jumped to 19.2 million. Last week marked 15 consecutive weeks with first-time claims in excess of one million. The ADP data was essentially a mirror image of its adjusted May numbers, meaning the growth merely backfilled the additional reductions in May.

Let’s re-emphasize: adding almost five million jobs is good for the economy, especially when the hiring coincides with an increase in the number of people in the workforce, which is what happened in June. What has economists concerned is the fact that the June hiring was mostly unaffected by the rapidly rising number of new infections in the U.S. The most acutely affected areas in the South and Southwest are now seeing pullbacks on business openings and on customers willing to risk “normal” activities. Don’t be persuaded by the images in the media of crowded bars and parties. As the hospitalizations are increasing, citizens in the areas affected are reducing their exposure. That means there will be pressures to reduce costs for businesses in those areas soon. And, in the final analysis, the economy doesn’t really re-start until the schools do. That prospect is looking grimmer now.

The problem continues to be a public health problem first and an economic problem second. Leaders cannot re-start the economy by imposing their will. This isn’t a partisan phenomenon. Yes, the first states to see new surges were red states with governors who have had to walk back their bluster. California is also seeing record spikes, and they were the first state to shelter at home, and California’s Gov. Newsome is a deep blue Democrat. You only need to look at Allegheny County to see that taking your eye off the ball for a couple of weekends was enough to fire community spread again.

There is a potential upside to this new spike in infections. It may drive people to finally act as though a highly contagious virus is sweeping the U.S. That might push enough people to capitulate to preventative measures, like wearing masks outside their homes, to impede the spread. In stock market terms, capitulation is when the last of the bulls finally sell off. Every stock market crash eventually has a capitulation point, after which recovery begins. Let’s hope the June flare-up, which will set the economy back for a spell, is that capitulation point for COVID-19. Until there is a vaccine, what stops the virus in its tracks is not having hosts. Following the simplest of preventative measures deprives COVID-19 of its oxygen to spread.

It’s giong to be a tough time to own a bar, or a theater, or a football team for that matter, until a vaccine is delivered. But stamping out the spread gets us a long way back to economic growth.

On the bidding front, Canonsburg-Houston Joint Authority put the $28 million 2nd phase of its wastewater treatment plant modernization out to bid, due Aug. 17 according to the Builders Exchange. Massaro CM Services is managing the bidding of the $7 million PSU West Campus Chilled Water Plant in State College. TBI Contracting was the low bidder on the $2.7 million spec Alta Vista Lot 10A industrial building in Washington County. Carl Walker Construction is about to start work on the 376-car parking garage at the Vision on Fifteenth office building in the Strip District.