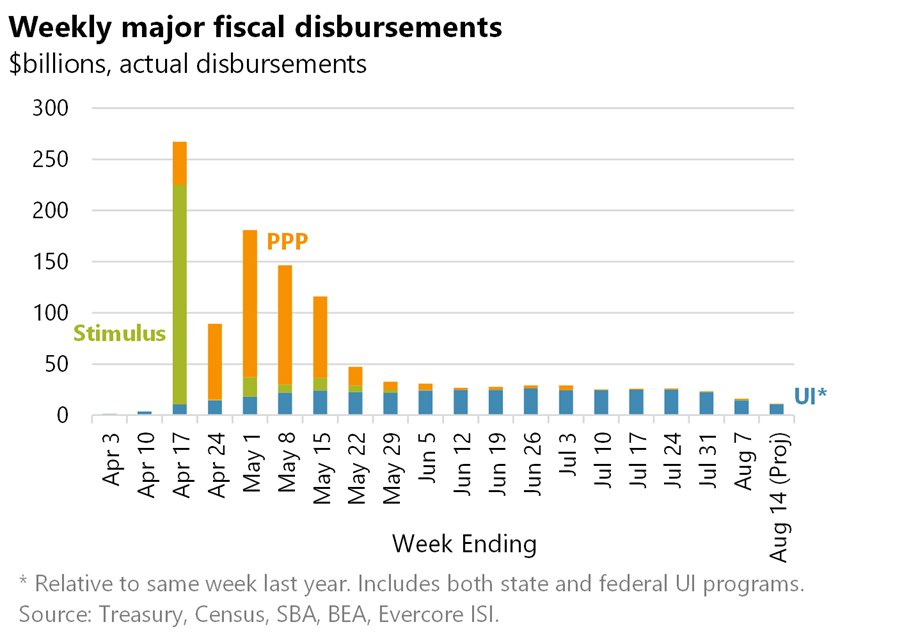

Congress and the White House seem to be ready to get a second major economic aid package done (or not). I have to admit that I don’t understand the politics of this latest round of stimulus talks. An unpopular sitting president, struggling in the polls, would normally be cheerleading a bill home that put thousands of dollars in the hands of voters in the last weeks before an election. But these aren’t normal times. This morning’s press conference by Speaker Nancy Pelosi characterized the negotiations as “just about there,” which gave Wall Street a boost after a brief plunge this morning. The S&P 500 fell 20 points by 10:00 but is now up 17 points from yesterday’s close. Reports from the Senate are less encouraging. Majority Leader McConnell is reported to be against passage of any aid ahead of the election, fearing it will limit Republican leverage in the event the Senate flips to a Democratic majority.

The best case for the stimulus came at 8:30 this morning, when the unemployment claims report for the week of Oct 17 was published. The good news: first time jobless claims fell under 800,000 for the first time in a while. The bad news: total unemployment insurance claimants have fallen by less than 8,000 since Oct. 3. The total number of people receiving unemployment claims was over 23 million.

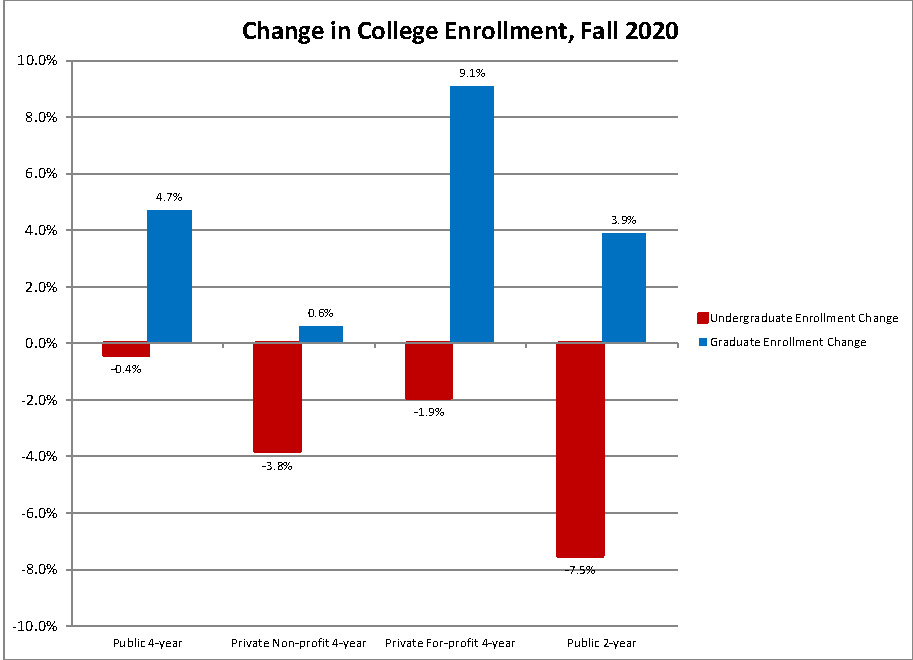

Setting the politics aside (since politics will not feed the family or pay the rent), the need for more aid is clear as a third increase in infections and hospitalizations washes over the U.S. Doctors and researchers are still learning about COVID-19 but what is abundantly clear is that it will continue to drag down the economy until a vaccine is found. Because the opinions about how to deal with the outbreak have become politically polarized, a central economic reality has been glossed over. That is, that the steep decline in demand for services in major sectors of the economy is due to consumers avoiding those sectors to avoid the infection. Marker posted an excellent article about this demand shock. It’s not shutdowns that slowed the economy. Consumers have shown they will be wary, regardless of the government’s position. The best example of this is Sweden, where the official approach has been to allow the virus to move through the less vulnerable population to achieve herd immunity. Sweden’s GDP declined 8.9% in the second quarter without lockdowns. Its neighbors, Finland and Denmark, saw decline of less than 6%, even though they imposed short-term lockdowns and guidelines like mask-wearing and limited gatherings. A slower economy seems inevitable until a medical solution is found. Government aid for those impacted the most will help keep a floor under the economy until then. Absent such aid, evictions and foreclosures will begin to spike. What follows that is a double-dip recession. At this point, there aren’t any fiscal conservatives left in Congress. Moreover, there are some compelling cases made for the efficacy of borrowing money at near zero rates to stimulate growth above 3% again. Fiscal policy can tighten once the corner has been turned.

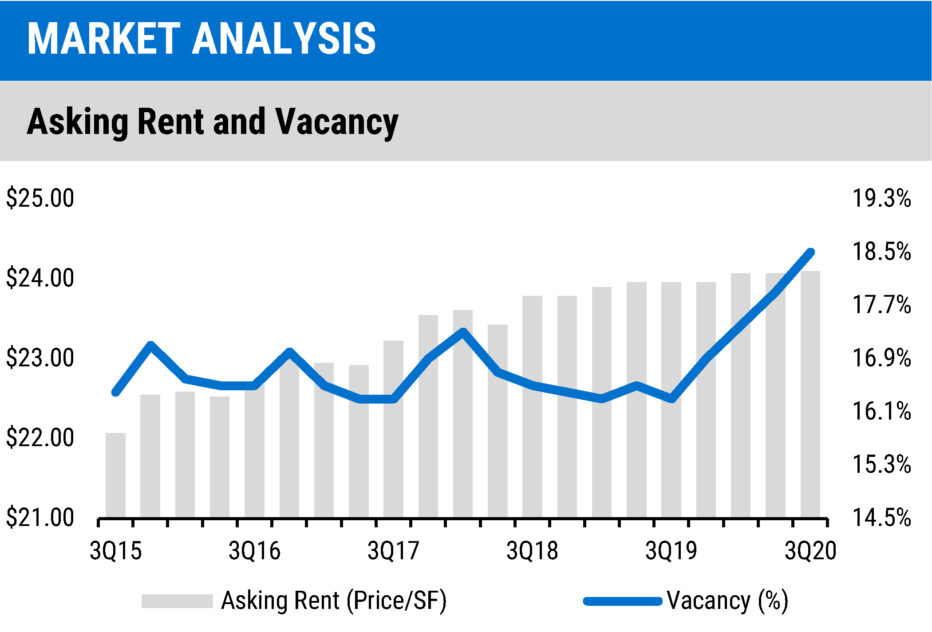

At the regional level, while unemployment in Pittsburgh is higher than most of its benchmark cities, the real estate market is recovering. Residential real estate has, in fact, seen growth across the board, with the exception of apartment construction. Sales of homes and home values have risen sharply. New construction of single-family homes is up over 29% year-over-year. New multi-family projects have fallen off last year’s pace. Through nine months, there were only 785 new apartments built in Pittsburgh, compared to 1,459 during the same period in 2019. Commercial real estate is beginning to reawaken as well, particularly in the industrial sector.

In construction news, Pittsburgh Glass Center took proposals from A. Martini & Co., Dick Building Co., A. M. Higley, and Massaro Crop. for its $6 million expansion. Burchick Construction is doing a $3 million build-out for Oculus on the 3rd floor of Schenley Place. Burns & Scalo Real Estate is building out a $12 million research space for Hillman Cancer Institute and a $4 million wet lab space for NeuBase at The Riviera. Al. Neyer was selected to build the second 60,617 square foot building for Elmhurst at the Heights of Thorn Hill. DiMarco Construction was awarded the general contract on the $3.8 million Robinson Township Police Station. Allegheny Construction Group is CM for the $4 million Jefferson Hospital chiller replacement. BJ’s Wholesale Club is taking bids on two 100,000 square foot-plus new stores in Ross and South Fayette. The $33 million New Kensington Wastewater Treatment Plant Upgrade is due Dec. 8.