Thursday morning’s report on first-time unemployment claims brought (relatively) good news on the state of the economy. First-time claims for unemployment fell by 228,000 to 963,000. That marked the first week in which claims were below one million since March. The relief felt by the decline in unemployment claims is tempered by the fact that the 963,000 claims is the highest in U.S. history prior to the pandemic. Some 28.3 million American are receiving unemployment compensation of some sort as of July 31.

The drop in unemployment claims is the second bit of improvement news issued during the past week. The Census Bureau announced last week that durable goods orders jumped for the second straight month, climbing to $207 billion in July (see chart below). Durable goods shipments declined from nearly $250 billion in February to $168 billion in May. The increase in purchases of durable goods suggests that consumers are more willing to spend on bigger ticket items than they were during the shutdown.

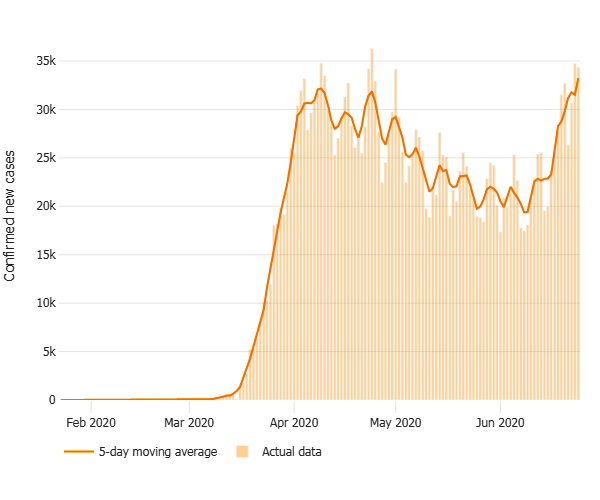

Other reports on economic activity during the second quarter were not so upbeat. As expected, the first reading on GDP in the second quarter showed a 9.5% decline from March to June. That’s a 32% drop on an annualized basis. The shutdown in economic activity from mid-March through May made such a decline inevitable. Economists expect that the increase in activity will be strong, although the renewed outbreak of COVID-19 in most of the U.S. since mid-June is going to slow the pace of growth. Job creation slowed in July after two months of robust hiring. Employers added 1.7 million jobs in July. That level of hiring was not enough to offset the cumulative number of first-time unemployment claims during the month. Unemployment continued to fall in July, to 10.2 percent.

While the shelter-at-home orders stopped economic activity cold in the spring, a look at indicators of consumer behavior since the outbreak hit the U.S. reveals the difficulty policy makers faced. Those who viewed the shutdown of businesses as a cure worse than the disease overlook the reality that people were going to alter their behavior because of the pandemic, whether the government mandated it or not. The chart below reflects insights on three metrics of consumer behavior. The number of dinner reservations and travel trips plummeted from March to April, and have remained at depressed levels through July. In response to the plunge in mortgage rates, home buyers have bucked the otherwise negative trends to purchase houses in much greater than normal volumes. The housing industry in general has been one of the few bright spots in the economy.

Construction news is limited in mid-2020. Bidding has slowed precipitously. Construction has proceeded on a few projects that were in the pipeline for 2020. Rycon Construction started work on the $38 million Fifth & Clyde Student Residence for Carnegie Mellon. PJ Dick started work on the $55 million Pennley Place mixed-use development in East Liberty. Seneca Valley School District awarded contracts for its $48.8 million Evans City Elementary School. Rycon Construction is the general contractor. Franjo Construction was awarded the contract for the $5.5 million new Munhall Borough Building. Franjo also started construction on two condos in Lawrenceville, the 24-unit Lawrenceville Lofts and the 21-unit Penn 23 condo. Turner Construction is the contractor for Perkins Eastman’s fit-out of 15,000 square feet in 525 William Penn Place. Dancing Gnome selected A. Martini & Co. for its $1.6 million expansion in Sharpsburg. TBI Contracting was selected for the $1.5 million new Derry Township VFD.