First the correction: The construction manager for the heating cooling plant at AHN Forbes Regional has not been awarded. PJ Dick was reported in error.

Most of Western PA began the transition from shelter at home to resumption of business today. A number of states across the country have mostly normalized over the past week or two. After two months of business being shutdown, a severe recession has begun. As if to emphasize that point the Commerce Department reported this morning that retail sales slipped 16.4% in April. It’s hoped that the resumption of business will begin the recovery from that recession. What’s unknown about the coming months is the degree to which consumers and businesses will “normalize” without a medical treatment or vaccine for the coronavirus. Photos from Wisconsin bars earlier this week suggest that drinkers will flock back, but evidence from other states that reopened suggest people aren’t yet ready. What’s somewhat encouraging is that, despite the staggering loss of jobs, there is dry powder to deploy.

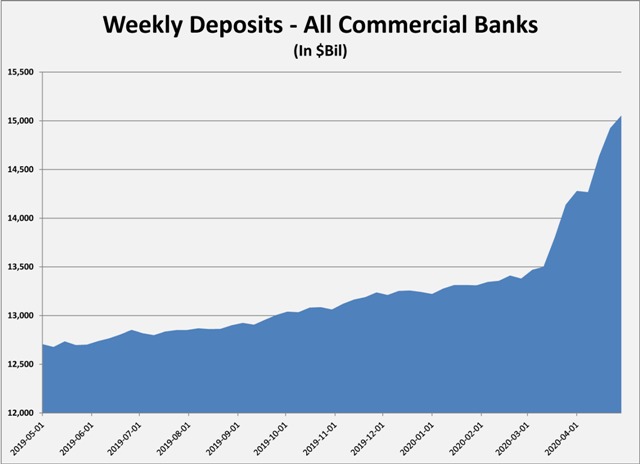

Since the shelter at home orders began in most states, there has been a dramatic rise in bank deposits. According to the Federal Reserve Bank of St. Louis, more than $15 trillion was on deposit in commercial banks across the U.S. on April 30. The bank data does not tell how those deposits are distributed among depositors, but that’s a pile of cash to support pent-up demand. It will also serve as a reserve for those who will be without incomes for some time.

That pile of deposits is also a great foundation for the nation’s finance system and is one of several key differences between the conditions right now and those that prevailed in 2009. The drunken overextension of credit in the mid-2000s led to a financial crisis that dragged the world into the Great Recession. This recession came on the heels of a strong economy, which was reflected in a strong commercial finance system. That system has begun responding to the recession, getting more conservative in its practices. That will be a headwind to recovery, especially for commercial construction, but it will also allow lenders to respond freely when a recovery is perceived. A lot of water still has to go over the dam but here are a few of the observations about financing at the moment:

- Lenders are responding to the market, not a crisis of their own making.

- Loan-to-value ratios have been pulled back to 60%, even to 50% for some risk-averse lenders.

- Life insurance companies are cherry-picking projects for the most part, seeking conditions like the banks want.

- CMBS, which cratered in 2009, is finding demand for its bonds, selling deals at low risk premiums.

- Banks are pretty much the only game in town for construction financing.

- Banks want to do construction loans with low leverage, strong income prospects, and a clear exit to permanent financing.

- Private equity is still plentiful and opportunistic, looking for sweetheart deals.

This is not to suggest that it will be easy to get a construction loan (or permanent financing for that matter). There are still regulatory reins on lending that will curb the most aggressive lenders. And lenders have wasted little time getting more conservative. But because liquidity and portfolios are solid, commercial lending can respond to demand. That wasn’t the case in 2010 or the years that followed. There is also still time for delinquency and defaults to grow to levels that will impede lending. Lenders who are able are building reserves so that they can respond to opportunities and avoid being hamstrung by regulatory limits on what is set aside to cover bad loans. PNC’s sale of Black Rock is a good example of that.

The regional bidding market has responded quickly to the reduction in volume. Two major projects bid this week and the results were well below the budgets. The Builders Exchange reported on the low bidders for CCAC’s Workforce Training Center and ALCOSAN’s North End Plant. Rycon Construction was low on the CCAC general contract and the $23 million total was more than 20% lower than the $30 million budget. ALCOSAN had budgeted $120 million for its project. The low bids came in at $100.3 million, with Mascaro Construction low on the general package at $94 million.

The low bids were something of a surprise, given that construction costs are going to be increased somewhat by the heightened jobsite safety measures put in place to counter the pandemic. The bids do reflect a shift to a significantly more competitive bidding environment.