First the good news: improvements in workplace safety have helped push losses and Workers Compensation claims lower, which is expected to keep the insurance bill at the same rates or lower in 2020. Insurance for environmental contractors is also expected to be slightly less expensive in 2020. For the rest of the insured market, not so much.

Natural disasters and unlimited liability exposure have pushed the property/casualty sector of the insurance industry into unprofitable territory. Insurance companies have done well with investments and at attracting capital in recent years. Some $800 billion in excess capital exists in the insurance industry, but the additional capital is not expected to translate into more capacity for property/casualty lines. This is in direct opposition to what is going on in the construction surety market, which has seen steady low loss ratios for a decade and plenty of capacity for higher bonding limits. Insurance industry experts see the industry conservatively deploying and investing its capital, rather than expanding the capacity for property/casualty insurance. In fact, several of the industry’s biggest insurers are debating an exit from property/casualty insurance.

The biggest culprit is catastrophic losses on natural disasters. Regardless of your politics and beliefs about the impact of climate change, the frequency and severity of catastrophic natural disasters has increased. Floods, tornadoes, hail storms, and wildfires have all caused much greater damage than in previous decades. Houston, for example, has seen two 500-year flood occurrences in the past three years.

Likewise, the frequency and severity of liability claims have increased, with insurers seeing little hope of tort reforms or limitations in the offing. Casualty claims and losses, even for companies with risk-mitigation strategies in place, have increased.

Insurers, not surprisingly, are responding to these unfavorable trends by employing more conservative underwriting standards and raising premiums. It’s easy to shake a fist at the insurance company but it’s important to realize that the premium charged an insured is a calculation of the relative risk of the activity as a whole, in addition to the judgment of the insured’s risk. In other words, if the activity – such as driving a car – has become more expensive to insure or has an increased risk in general, the insurer needs to collect more money to respond to claims. Those actuarial calculations are the foundation of the insurance business. Companies can shave insurance costs by being safer but when insurance conditions become more expensive, everyone pays.

According to USI’s Commercial Property and Casualty Outlook for 2020, insurers expect to raise premiums on most property policies between 10% and 20% for most non-catastrophic property coverage, and as much as 60% for insurance with catastrophic coverage. Auto liability insurance is forecast to increase by 10% to 25%. Excess liability will go up 10% to 25%, as will errors and omissions. The cost of public company officers and directors coverage is set to increase 25% to 50%.

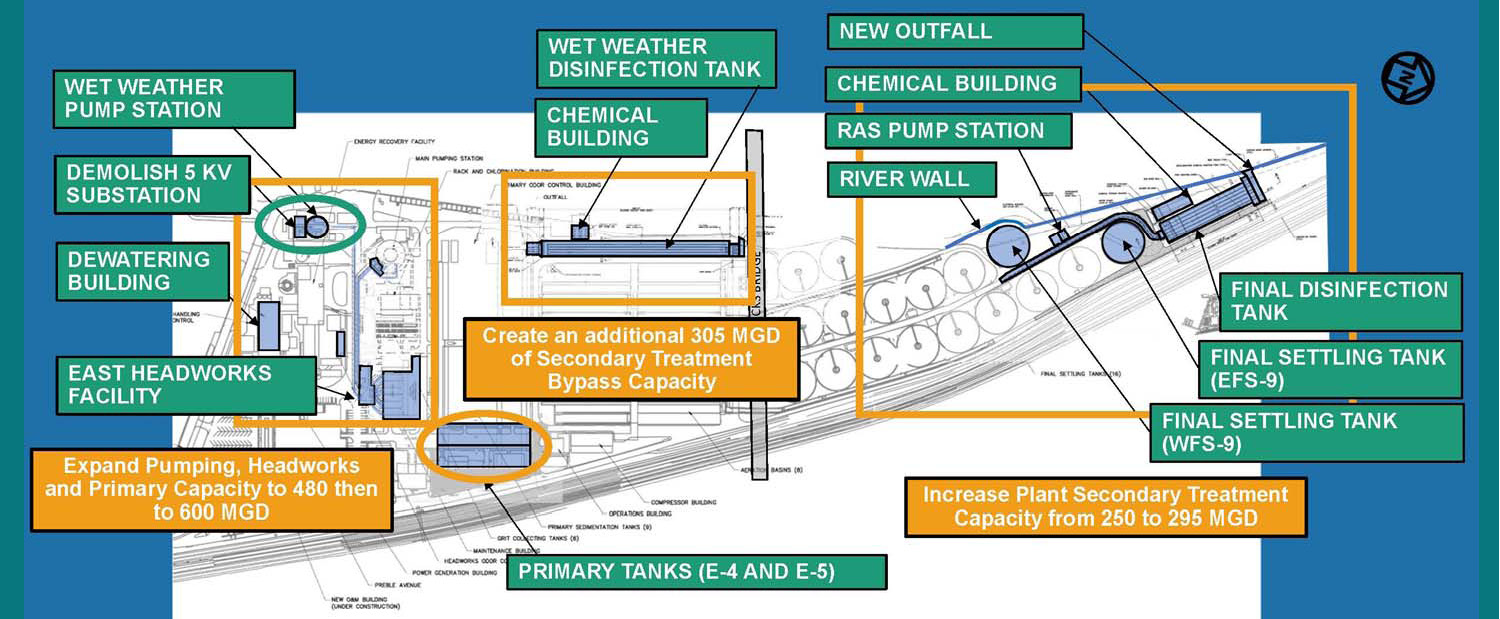

Regional construction news: ALCOSAN’s $130 million North Plant Expansion will be advertised for bid at the end of January. Duquesne University selected Jendoco Construction for its $18 million St. Martin Hall renovation. Fluor has issued the second phase package of US Steel’s $900 million Edgar Thompson Works modernization. The package includes a 50,000 square foot building. Mascaro, Songer and Stevens are expected to bid. Mascaro was awarded the $12 million first phase of the work. The $10 million, 376-car parking garage for District 15 should be bid by Carl Walker Construction after January 27.