The Bureau of Labor Statistics put out its monthly report on inflation last week and it had good news for the construction industry. The global demand freeze since March has neutralized most of the supply imbalances

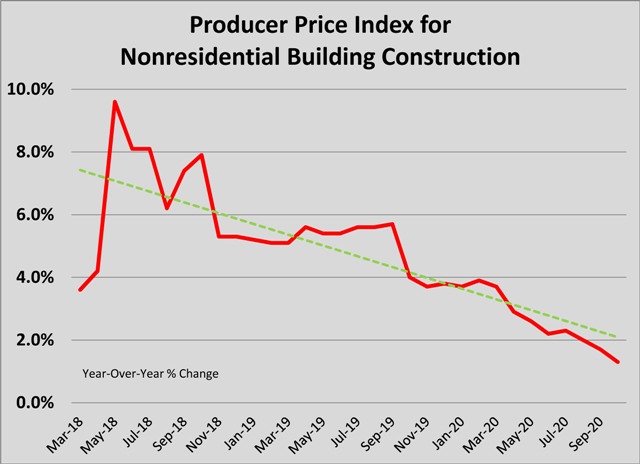

Two years after nonresidential building inflation hovered at 8%, the producer price index (PPI) for nonresidential building jumped 0.2 percentage points to a mere 1.9% year-over-year. That PPI was flat from September to October. Material prices were less volatile across the spectrum, with most of the month-to-month variance between zero and one percent, up or down. The few outliers mostly related to the decline in oil prices or the shift in lumber markets. Moreover, all of the changes greater than one percent were price reductions.

This environment of falling material prices is supportive of the recovery in construction that should gain strength as multiple vaccines become more widely distributed throughout the first half of 2021. Unlike during the 2003-2004 recovery, when spikes in steel and oil prices derailed many projects (remember Children’s Hospital anyone?), the current environment should enable recovery rather than hinder it.

Bidding and proposal activity has picked up in recent weeks but remains slow. Because of the time of year, however, it’s tougher to judge whether or not this is picking up to a more normal pace (which would be slowing to the holidays). Architects and engineers are hiring and reporting more RFPs. Contracting volume in October topped $300 million for new work. That’s about normal for the season. Election results have provided cheer to investors, despite warnings from the right that a change in the White House would chill recovery. The COVID-19 outbreak now underway is going to bring disastrous public health results over the next 60 days, I fear, but the other side of the pandemic is in sight. That seems to be offering optimism about 2021. Extending the bridge to the rollout of vaccines would build a strong foundation under the recovery in 2021, perhaps even assuring that growth booms in the second half of the year. Congress seems unwilling to unite to build that bridge. Recovery doesn’t depend on it but the strength of the recovery in 2021 does.

Civically Inc. and Bridging the Gap LLC selected A. Martini & Co. as general contractor for the $6 million Hunter Building re-use in Wilkinsburg. Wexford Science + Technology reported that its new $100 million life science research building at 5051 Centre Avenue should start next spring. Turner Construction is the CM. Massaro Corp. is budgeting the $51 million Fifth & Dinwiddie project. Mele & Mele & Sons announced that it is building a new 38,000 square foot office and maintenance shop at the RIDC City Center of Duquesne. Goldfish Swim Club is taking bids from A. W. McCay, A. Martini & Co., & Rossman Hensley on its $2 million buildout of the former Community Supermarket space in Fox Chapel Plaza. Mortenson is taking trade package bids Dec. 8 on the $45 million Lasch Building expansion/renovation at Penn State.