If you’ve watched enough college football over the past five years or so, you have noticed a number of teams gathering at the end of the third quarter and holding four fingers up as they prepare to start the fourth quarter. It’s a rallying cry to finish the game strong, a recognition that how the team finishes the fourth quarter matters. That visual works for the U.S. economy right now. Congress should be holding up four fingers, especially as it appears likely that a couple of vaccines could begin rolling out by the end of 2020. The literal end of 2020, December 31 is looming as an economic cliff that could set recovery back even as the COVID-19 virus is contained. In most years, the period from now until New Years Day is particularly unproductive for Congress. In lame duck years, that’s more so; and in lame duck presidential years (like 2020), the tendency is for next to nothing to happen. With Republicans trying to use the lame duck to ram through last-minute appointments, the attention of Congress should be diverted long enough to address the looming expiration of key safety net measures. If a vaccine to end the pandemic is truly looming for 2021, the nascent economic recovery should be given as much fuel to grow as possible.

The economic recovery has been judged to be durable because of the relatively strong rebound during the third quarter and the (apparently) short runway to a viable vaccine to end the pandemic. The timing of this assessment is particularly worrisome, however, as we are entering a period of heightened risk, even as the delivery of a vaccine seems likely to be sooner than expected. Setting aside the unknown impact of the surge in COVID-19 infections as winter looms, there are known risks that could sabotage the economy just ahead of a recovery. More than 12 million unemployed persons will lose compensation on December 31 without an extension or passage of further assistance. On that date the moratoria on foreclosures, student loan payments, and evictions expire. Household savings will have been tapped for an additional three months since the rosy third quarter estimates.

Most of the aid or stimulus programs passed in 2020 were meant to be bridges to the vaccine. When the CARES Act was passed, there was no realistic estimate of how long that bridge needed to be. That fact made it difficult to gain agreement on subsequent aid legislation. As the holidays approach we have a pretty clear idea of the length of the bridge. Failing to extend the safety net for tens of millions may not prove to damage the recovery but, with the duration of another round of aid being 90 days or so, providing that safety net assures that there will be demand for a recovery that will be sorely needed. We don’t need another extended weak recovery a la 2010-2015.

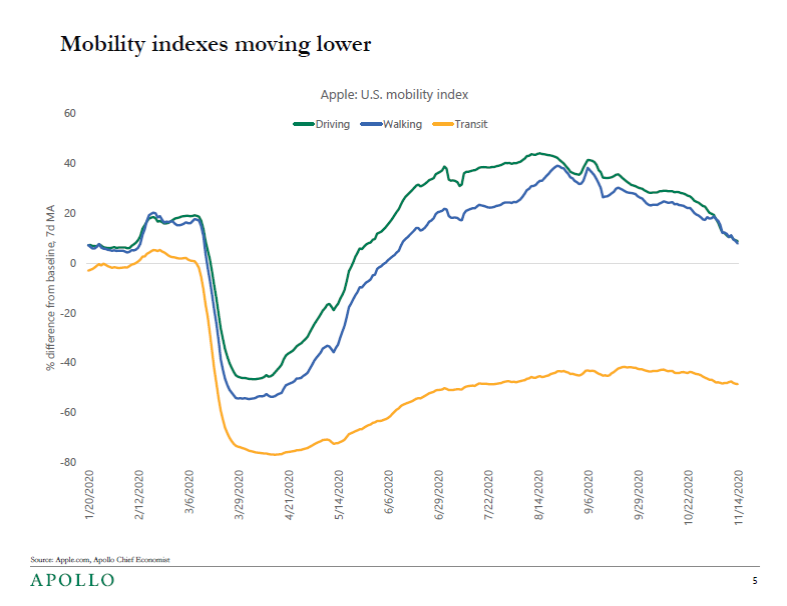

JLL’s chief economist, Ryan Severino, discusses the case for more stimulus in his weely email today. Former U.S. Treasury Dept. economist Ernie Tedeschi talks a lot on the subject on Twitter @ernietedeschi. The upshot of the current situation is that the spike in COVID-19 hospitalizations and deaths is driving economic activity lower just ahead of a time when the unemployed are going to become vulnerable (along with a lot of low wage earners in the hositality industry). Personal savings has soared since the pandemic started. The current savings rate remains at 14% (It was 1% ahead of the Great Recession by comparison). There is $6.5 trillion in money market accounts looking for a place to deploy. That capital will fuel the supply. The demand will come from consumers, who provide 70% of GDP. They, and the economy, are vulnerable as the year ends. The chart below shows just how much people have altered their behavior and spending as the COVID-19 cases spike again. Extending the safety net another 90 days could make a world of difference to an economy in the midst of a vaccine rollout on April 1.

One sector of the Pittsburgh construction market that has been surprisingly disrupted by the pandemic is multi-family. The economic disruptions caused by COVID-19 were expected to cause some pain for apartment owners but the case for apartment development should not have been dented. If anything, the economic case for renting instead of owning grows during recessions. It doesn’t appear that it has been the economic justification that has slowed multi-family construction, but rather the execution of plans to build. There is still a pipeline of several thousand units in development but roughly 1,200 to 1,500 units that were scheduled to start in 2020 aren’t going to get underway until next year. When Al. Neyer Construction starts site work on the 150-unit 5803 Centre Apartments in December, the project will bring the total for 2020 to about 950 units of new construction, about half what was forecasted. The good news is that the business case for the 1,200 or so units that were delayed has not eroded. Apartment construction in 2021 should return to the 2,000-plus unit pace again.

Neyer is currently taking bids on the 5803 Centre project. Elford Construction has been taking bids on the 370-unit Brewer’s Block Apartments in Bloomfield. Elford is bidding to partner with RDC Design + Build on that project. Massaro Corporation was selected as CM for Conemaugh Hospital’s $50 million Building D project.