The Commerce Department released its first estimate of gross domestic product growth for the third quarter. The good news: the 7.4% jump from quarter two was just as expected. The bad news: the 7.4% jump from quarter two was just as expected. In this rarest of times, there is a lot of economic news that is two things at the same time. To wit: the big rebound was inevitable and, at the same time, insufficient.

The 9% plunge in the second quarter set the table for a big rebound, even though the third quarter started with a second surge in virus infections happening. That surge seemed to cement mitigating behavior in the minds of most U.S. consumers. By wearing masks, maintaining safe distances, and doing things outside, more Americans were able to return to more normal behavior. That included shopping, dining, vacationing, and a host of activities that stopped from mid-March through May. Most economists saw data that predicted growth of more than 7% (that annualizes to 33%, although no quarterly growth remains the same for a year – also true when the second quarter fell 31% annualized). It was also apparent to observers that the stagnating hiring and increasing layoffs would cap the growth below 8%.

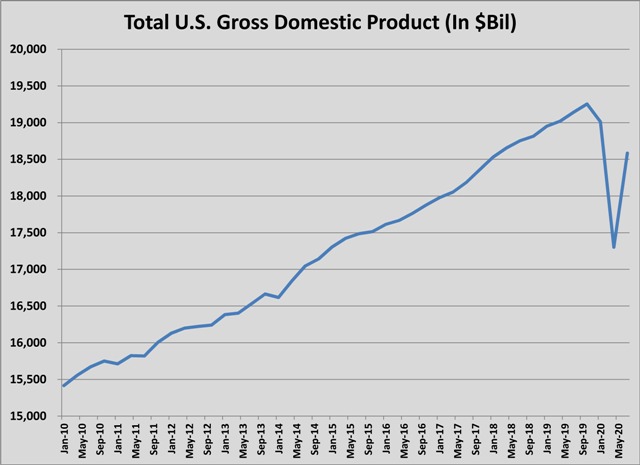

Reactions to the news ranged from relief to caution, except for Republican candidates for office. While there was almost no chance that GDP growth was going to be poor, it was still good to see expectations confirmed. At the same time, it’s obvious growth has slowed in September and October. It’s also true that the recovery in GDP is only two-thirds of the way back to where the U.S. economy was in the first quarter. At $18.5 trillion, GDP is almost exactly where it was in January 2018 and is 3.5% behind the third quarter of 2019. Moreover, the current level of GDP output is 7% behind where GDP would be if the 2.3% annual growth rate of the first quarter had continued. So there’s work to be done.

Reactions to the news ranged from relief to caution, except for Republican candidates for office. While there was almost no chance that GDP growth was going to be poor, it was still good to see expectations confirmed. At the same time, it’s obvious growth has slowed in September and October. It’s also true that the recovery in GDP is only two-thirds of the way back to where the U.S. economy was in the first quarter. At $18.5 trillion, GDP is almost exactly where it was in January 2018 and is 3.5% behind the third quarter of 2019. Moreover, the current level of GDP output is 7% behind where GDP would be if the 2.3% annual growth rate of the first quarter had continued. So there’s work to be done.

It’s important to have confirmed the expectations for a third quarter bounce back, if only to feel comfortable that there’s a foundation for 2021 recovery. With a vaccine seeming more likely to be first available in early 2021, more economists are forecasting improvement next year that will lead to full recovery in 2022. On Wednesday, Urban Land Institute released its ULI Real Estate Economic Forecast for 2021. The survey of 43 leading economists and analysts predicted above average GDP growth and job creation in 2021 and 2022. The summary paragraph is below:

The results of the survey, which is conducted semi-annually, expect GDP to decline 5% this year but increase again in 2021. Respondents forecast 3.6% GDP growth in 2021 and 3.2% GDP growth in 2022. The 2020 GDP loss is an improvement compared to the prior survey, which estimated a 6% fall in GDP this year. However, the previous survey was also more optimistic about GDP growth in 2021 and 2022, forecasting 3.9% and 3.6% respectively. Employment follows a similar trend. This year, the survey expects jobs loss to total 9 million, but—like GDP—job growth will begin in 2021 and 2022, growing by 3.5 million and 3 million jobs, according to the survey. By the end of 2022, unemployment could fall to 5.5%.

There are still a host of consumer activities that will remain depressed until the fear of COVID-19 recedes. And it’s important to remember that it’s the fear that is depressing the economy. It makes good political theater to blame lockdowns or rage on about not living in fear but, across the planet, at least a quarter of the people aren’t taking chances by going back to normal indoor socializing or gathering. Sweden is often pointed to as a model of allowing normal activity while protecting the vulnerable. That model produced one of the highest death rates per capita in the world, plus a decline in GDP of 8.3% during the second quarter. Sweden’s neighbors, Finland and Norway had shutdowns of public spaces (including businesses) and mandated masks. The death rate per capita was 10% of Sweden’s and their economies shrank by 4.5% and5.1% respectively. We’re seeing similar dynamics in places like Wisconsin and the Dakotas now, where surging infections are dampening commerce significantly.

That may sound depressingly like more bad economic news but, as we learn more about the pandemic and its outcomes (even if behaviors don’t change), the economic picture becomes clearer. That’s very important for the construction industry. Having some sense of predictability gives owners the confidence to build. If the expectation is that GDP will fall 5% or thereabouts in 2020 and recover by growing 3-4% in 2021, that’s a scenario that owners can plan to meet. Yesterday’s GDP numbers gave that forecast more validity. If behaviors change in the U.S. so that the spread of the infection slows or accelerates more slowly during regular flu season, then the forecast probably improves. Owners are like a pilot sitting at the end of a runway. COVID-19 has been a fog that obscured the runway. Pilots can adjust to the length of the runway if they can see it but few have seen where the runway begins or ends since mid-March. There’s little evidence that the economy will be soaring in 2021, even with a vaccine, but we can now see how it will get airborne again.

Little construction news but Mucci Construction was the low general contractor bidder on the $65 million Canonsburg Elementary School yesterday. The Digital Foundry in New Kensington held a virtual groundbreaking this week. Mosites Construction should start work on the $5 million, 15,000 square foot building in December. forge 39 Construction Management will be building the 100,000 square foot 250 Crown Court at Imperial Business Park in Findlay. Al. Neyer is building a 30,000 square foot addition to the Pella Showroom & Warehouse in Thorn Hill, Cranberry Township.