Amazon, Google, and Apple are three of the most important companies on earth in terms of total impact. This certainly extends to the realm of commercial real estate. In Pittsburgh, Amazon and Google alone are leasing or building about two million square feet of commercial space. It can be tempting to think of these companies as somewhat ethereal as most of us never have an in-person, real life interaction. The reality remains that all three of these companies require huge commercial real estate investments for office space, warehouse space, research and development, and much more. With this in mind, today we will review the impact that Amazon, Google, and Apple have on the US commercial real estate market.

Amazon Commercial Real Estate Footprint

A funny aspect of finding information about Amazon’s impact on the US CRE market is that most of the results are actually books, DVDs, and other materials about commercial real estate sold on the Amazon platform. Digging deeper, you will find that Amazon has perhaps the largest global real estate footprint in the world. In Seattle alone, the original headquarters of the e-commerce giant, their total square footage surpasses ~13 million. All of this before they announced plans to open a second, perhaps even larger American headquarters in Arlington, VA.

The new headquarters is expected to create approximately 25,000 jobs in its first decade or so of operation. Construction alone has been estimated to employ some 50,000 workers with an estimated budget of $5 billion. These two mega-headquarters garner all the headlines when it comes to commercial real estate, but the footprint extends much farther.

In Amazon’s own words: “More than 175 operating fulfillment centers and more than 150 million square feet of space where associate pick, pack, and ship millions of Amazon.com customer orders to the tune of millions of items per year. Specifically, in North America we currently have more than 110 operation facilities with a variety of employment opportunities.”

Google’s Impact on Commercial Real Estate

Google carries perhaps the smallest impact on commercial real estate of our three mega-corporations, but also impacts the industry in other ways. Google boasts over 70 office locations in 50+ countries around the globe including notable offices in Pittsburgh, San Francisco, and San Bruno, CA. Google employs over 100,000 employees both domestically and overseas. Where Amazon’s impact on CRE is relatively straightforward with massive warehouses and nearly 8 times the number of employees, Google’s impact can also be felt through their many data centers.

Google has over 20 data centers around the globe in locations such as Douglas County, GA, Mayes County, OK, and Hamina, Finland. As one can imagine, the data storage needs for a company like Google are comical. These data centers and other non-traditional commercial real estate needs are likely to grow in the coming years. This, alongside more traditional office growth and warehouse needs, means that Google will continue to drive CRE value for many years to come.

Apple Locations Impact Local CRE Markets

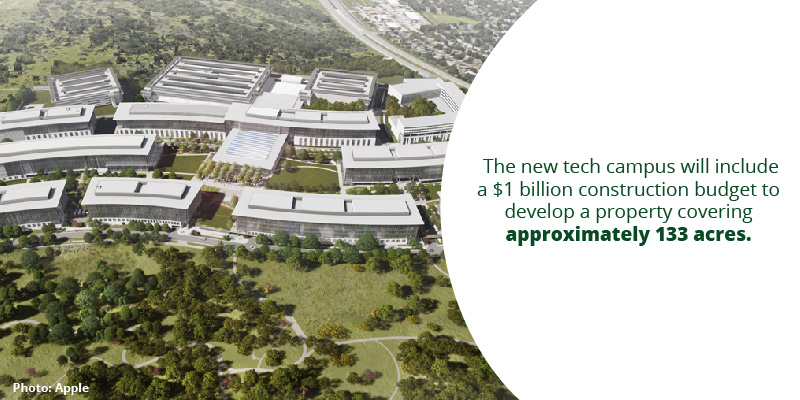

To examine how Apple impact local commercial real estate, let’s take a look at Apple’s recent decision to plant their second headquarters in Austin, TX. The new tech campus will include a $1 billion construction budget to develop a property covering approximately 133 acres. Local citizens have expressed both excitement and concern for the future local economy boon and the likelihood that prices will likely skyrocket for local real estate resources.

There is no question that when a sudden influx of cash and employment opportunities hits a mid-major market, the ripple effect touches every aspect of not only real estate, but the local economy overall. Real estate investors and current owners of local real estate can look forward to their property values climbing dramatically. For individuals who are renting their homes or businesses who are renting commercial real estate, this can pose a very real threat.

Situations like Apple’s decision to move to Austin is similar to the recent Amazon bids put in by medium sized cities like Pittsburgh. Local citizens expressed consternation that already rising pricing for real estate and other commodities would become downright unaffordable. That is the balancing act that must be struck when considering massive CRE and construction bids from any of these three powerful corporations.

Going Forward

The complexities of how Amazon, Google, and Apple affect the American real estate market are too many to distill into a neat article. Rising costs of living in tech cities like San Fransisco create situations where the wealthy are moving in and the average citizens might be leaving for greener pastures. These injections of local economic growth can also revive cities with lagging economies. Commercial real estate has trended towards the energy sector, tech sector, and infrastructure in recent years. Major corporations will continue to drive significant changes in CRE market value in the foreseeable future.