The carryover of the fourth quarter consumer panic nationally translated into much cooler demand for new housing in the first quarter of 2009, with fewer than 500 total units permitted. New construction averaged less than 90 new single family units a month in the first quarter. That is an unprecedented low volume since 1994, and probably those levels haven’t been seen since the early 1980’s.

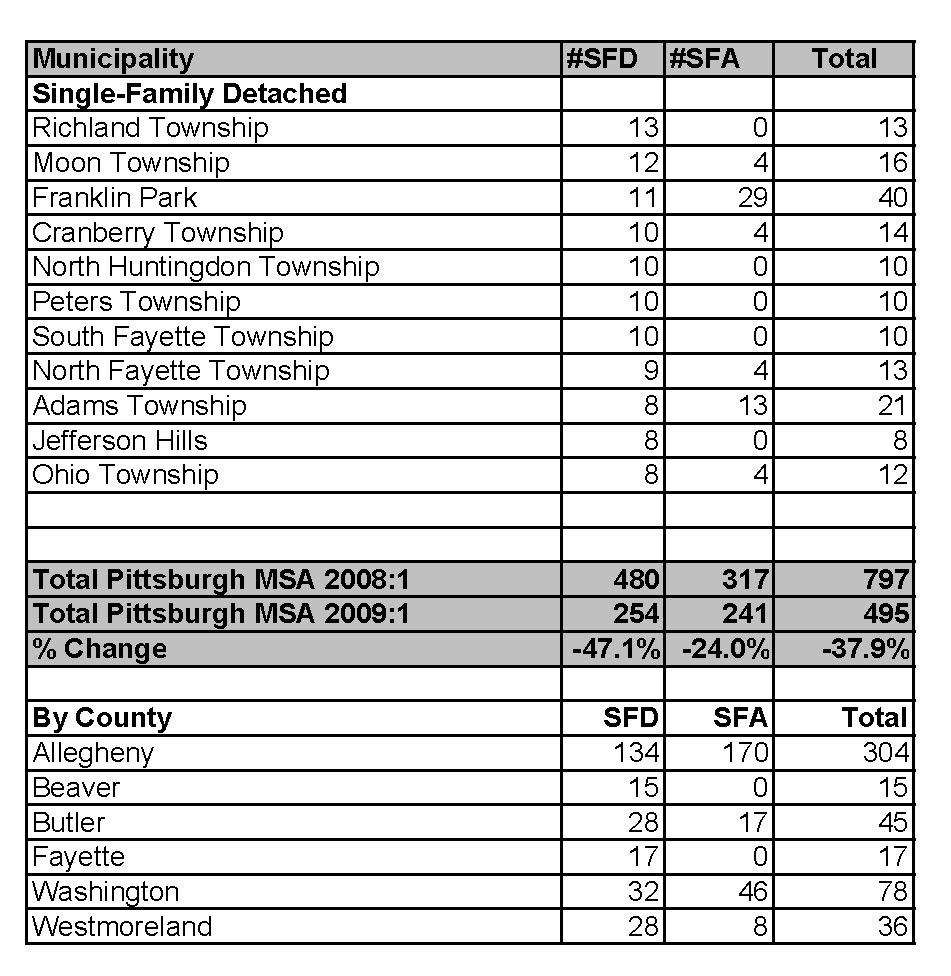

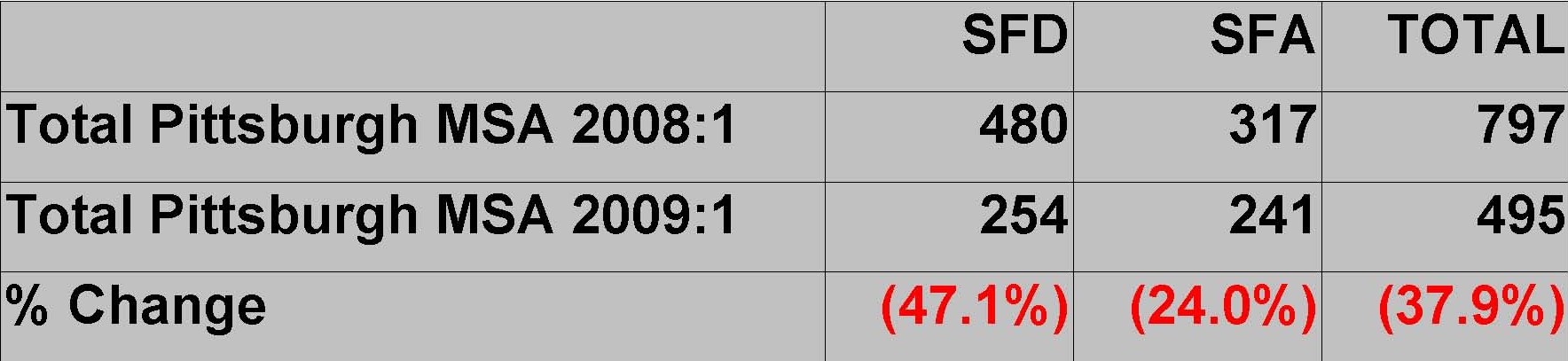

During the January through March period 254 permits were issued for single-family detached units, down 47.1% from the same period last year. Attached units also declined, with 241 units started compared to 317 during the first quarter of 2008. The overall housing construction market was down 37.9%.

March permits were about twice January and February numbers but there isn’t a lot of cheer from that. Although Pittsburgh’s economy appears to be outpacing the national conditions, the uncertainty translated to almost no demand in the first couple of months. Because there are so few spec builders in the region, slow demand means slow starts. Tall Timber Group is forecasting a pickup throughout the remainder of 2009, but expects permits for new construction will remain well below normal levels until mid-2010 or later.

March permits were about twice January and February numbers but there isn’t a lot of cheer from that. Although Pittsburgh’s economy appears to be outpacing the national conditions, the uncertainty translated to almost no demand in the first couple of months. Because there are so few spec builders in the region, slow demand means slow starts. Tall Timber Group is forecasting a pickup throughout the remainder of 2009, but expects permits for new construction will remain well below normal levels until mid-2010 or later.

Non-residential construction was down almost 20% from last year, but contracting volume was higher than expected, especially after February 1. Contracting during January-March was $471.5 million, down from $585 million in 2008. Most contractors have had plenty to bid since February 1, but it’s too early to say if that’s a return to a higher pace or just the lag from the slowdown of the previous three or four months. The pipeline still looks like owners and developers expect to start what was in planning last year, just a little later than expected.

Tall Timber still forecasts more than $3 billion in construction for 2009, even with the deferment of the USS Clairton project, but cautions that the forecast still includes a handful of projects totaling $1.5 billion. Competition for smaller to medium size projects is more intense, and I’m still not sure that owners aren’t bidding projects just to see how much prices have dropped. That sort of ‘test-drive’ mentality will hurt if the bids get shelved anyway.

The totals listed below represent the number of new housing units for which building permits were issued, excluding mobile homes and elderly care complexes. The top areas were: