Metropolitan Pittsburgh’s good economy could not overcome the fear that gripped the consumer in October and November, sending housing starts here to the lowest levels in two decades. Permits for new construction virtually stopped from mid-October through the end of November. You could literally follow the panic that was gripping Wall Street and see people here put the brakes on. Even with significantly higher activity in December the number of single-family detached homes started was 397, the lowest for any quarter since we began tracking activity in 1994.

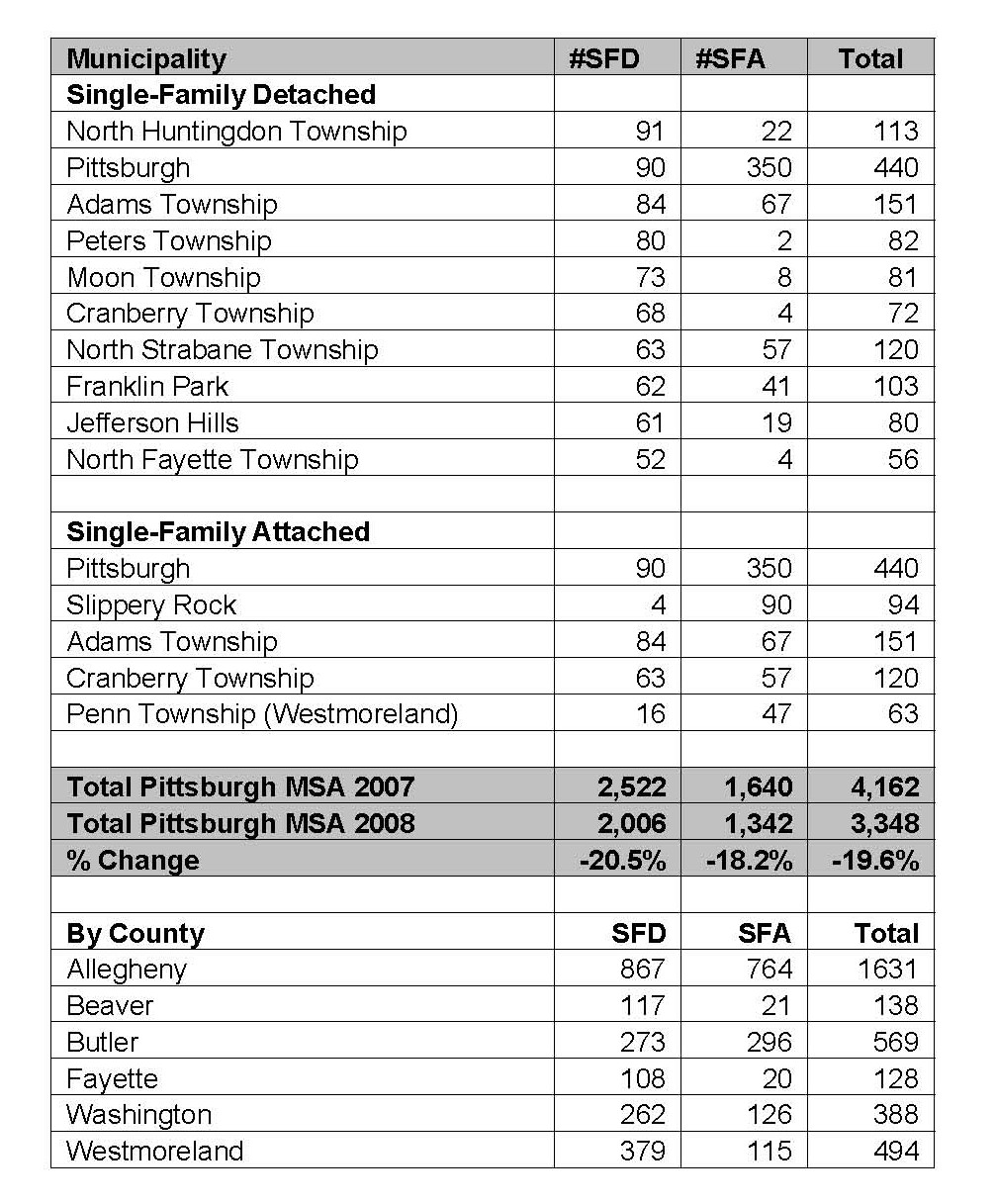

During the full year of 2008, permits were issued for 2006 single-family detached units, down 20.5% from 2007. The market for single-family attached and multi-family units was off similarly, with 1,342 units started compared to 1,640 started in 2007. The overall housing market was down 19.6% compared to 2007, and by more than 35% compared the cyclical high in 2004. I attribute the depth of the slowdown to the fact that most builders in the region are small and very well-connected to the market demand. Time and again, we see Pittsburgh’s builders react quickly when a market softens, which prevents the build-up of any significant oversupply of houses.

The other noteworthy development is the continued growth of new construction in the City of Pittsburgh, which experienced the second highest total of detached new units in the region, saw its overall new construction total increase by 24.6%, and issued permits for twice as many units of new housing as Cranberry and Adams Townships combined.

Non-residential construction remained at a high level in 2008, with $3.48 billion contracted for the year, less than a one percent decline from 2007. Contracting in the fourth quarter slowed dramatically, with volume being driven by three large projects. Setting aside UPMC East, Dick’s Headquarters and the Oakland VA jobs, there were less than $400 million contracted in the last three months. With more than $3 billion expected to be invested in the dozen biggest projects in 2009, this trend appears to be extending out for another few quarters, with less work for most of the market to pursue.

We are forecasting a modest increase in housing in 2009, with single-family growth of a couple hundred units, and an overall volume of 3,700 units for the metropolitan area. Because of the large investment in industrial projects like Allegheny Technologies Brackenridge plant, AK Steel and the USS Clairton Works, non-residential contracting should exceed $4 billion in 2009, but I expect the underlying commercial market to decline by more than 30%.

The totals listed below represent the number of new housing units for which building permits were issued, excluding mobile homes and elderly care complexes. The top areas were: