There were a variety of reports within the past week that seem to verify that the national economy has come off the mat and that the root causes of the recession are being remedied. Much potential exists for a second leg down for the stock markets, another fainancial market slide or implosion if the institutions have been hiding big losses and hoping for growth to cover them, but at least there is good national news.

Third quarter GDP was 3.5%, better than the 3.1% predicted. Cash-for-clunkers, ARRA accounted for much of the growth, however, so fourth quarter numbers should be tepid, maybe even negative. The Obama administration claims 3M jobs were created/saved, but unemployment has crested the 10% mark.

Housing market news is better. Total state existing-home sales, including single-family and condo, increased 11.4 percent to a seasonally adjusted annual rate of 5.3 million units in the third quarter from 4.76 million units in the second quarter, and are now 5.9 percent above the 5.01 million-unit pace in the third quarter of 2008.

Sales increased from the second quarter in 45 states and the District of Columbia; 28 states and D.C. saw double-digit gains. Year-over-year sales were higher in 32 states and D.C.

Financing for commercial development is showing life for the first time in more than a year. Several large insurance companies have alerted the brokerage community that their money is back in the market and are looking for deals. For developers the down side is the deals are not going to resemble anything like recent years, but most are willing to go 75% loan-to-value, a significant increase over the willingness to extend this spring. The estimates are that money coming back into play approaches $1 trillion

The most significant event of recent weeks was the Developers Diversified CMBS issue of $400 million, which sold out overnight with a reduced risk premium of 140 basis points on AAA bonds, compared to the 200 BP that was offered initially. The AA-rated portion of the bonds carried a yield of 5.75% and the A-rated portion was 6.25%. These aren’t substantially different from what was offered during the heyday of CMBS sales in 2006-2007. The assets backing the securities were retail properties which were government guaranteed under the TALF program. This isn’t a return to normalcy in the CMBS market but it clearly demonstrates demand for the products, and is at least the first issue in 18 months.

Pace of unemployment has slowed nationally, now around 200K jobs instead of 600-700K jobs in spring. Closer to home, October’s unemployment was flat in PA, with the actual number of people working rising slightly. In western PA the unemployment rate still rests more than 2% below the national rate

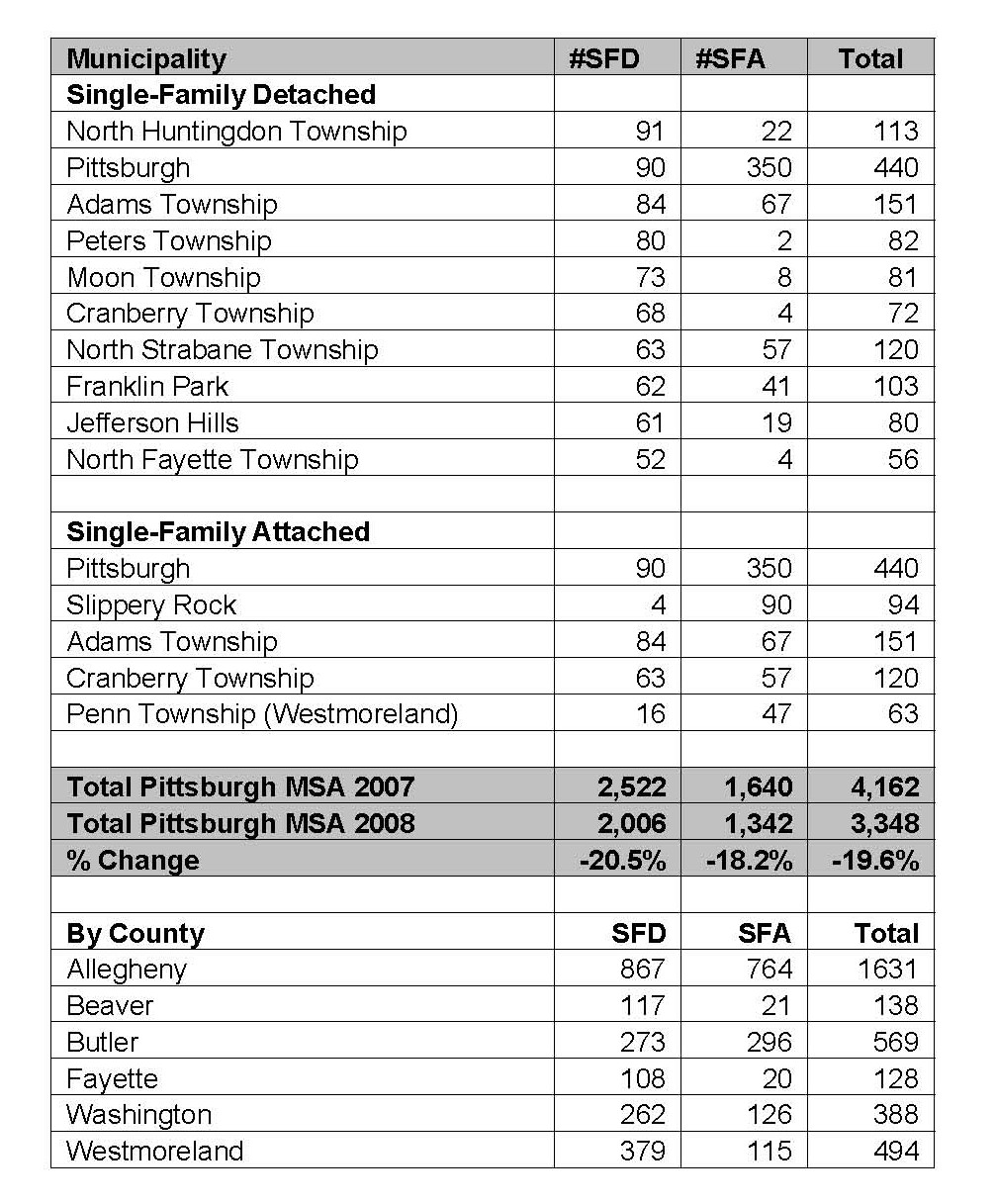

Finally, the most recent quarter’s numbers from the National Association of Realtors showed the prices rose in the Pittsburgh area, where the median price in the third quarter was $124,600, vs. $122,700 in the same quarter last year. Housing starts remain low in the region, which will support current housing prices by keeping inventory low.

None of this represents robust market conditions, but all of the data is consistent with what happens during the first quarters of economic recovery. Keep your fingers crossed for no more unexpected calamity.