There’s really nothing comforting about job losses and downsizing if it happens to you or someone you love is effected; however, from a macroeconomic point of view only, the current round of business reactions is something of a return to cyclical normalcy. From that perspective we have moved to the ‘situation normal, all fouled up’ (or something stronger) stage of the business cycle, where the degradation of demand dictates that businesses cut expenses to attempt to remain profitable, or stem the red ink.

Again, not good news, but given the chaotic beginnings of this recession, the layoffs are the beginning of a predictable response to the rythym of the cycle, and mark the response by business that is needed to begin the recovery.

The out-of-sequence part of this downturn was the credit disaster. What normally occurs is that slowing cyclical demand begins to cause inventory problems (for example building too many offices slows demand, which eventually leads to too many cans of paint, sheets of drywall, etc, in warehouses). As inventories stagnate, payment slows down and defaults occur. In response to higher defaults and longer credit cycles, the banks and financial institutions tighten (and sometimes freeze) credit. The slowing economy, coupled with a lack of credit, forces layoffs, consumer belt-tightening, and general austerity until demand becomes so pent up that expansion begins anew.

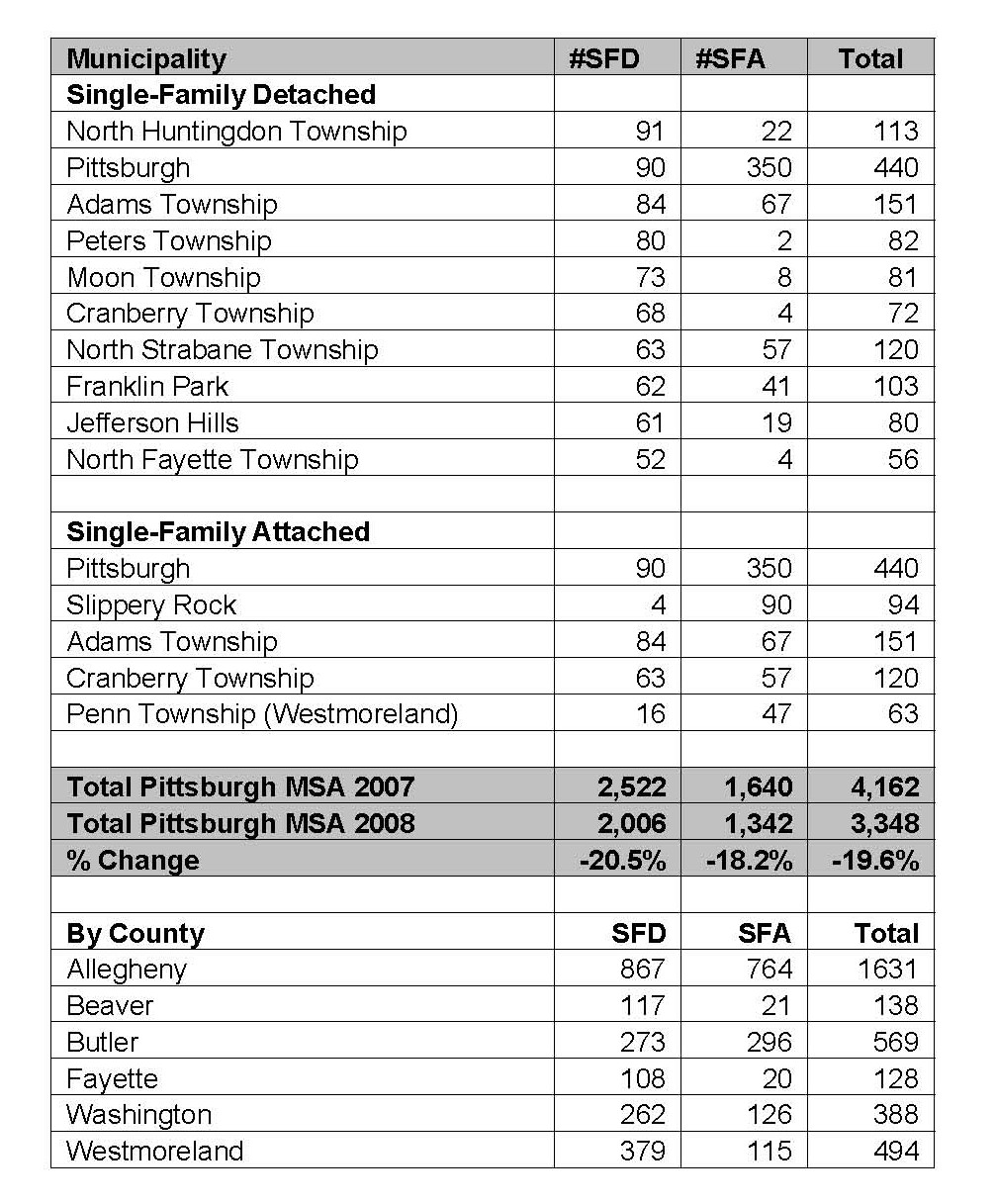

Because this cycle started with credit extended on the basis of rising home values that stopped rising, the unwinding of the financial support for real estate and construction began before the normal erosion of demand. Now that businesses are recognizing that 2009 will be tough and are responding by reducing overhead, the process of reaching the bottom (and therefore the beginning of recovery) can begin.

This is no consolation for the pain we’re experiencing, and there is no assurance that bottom isn’t still a ways off, but the single biggest issue facing the investment side of the economy has been the terrifying uncertainty that has prevented investors from assigning value to risk, and to the financial system. Construction relies on investors assessing the risk of development relative to the lost opportunity of missing out on demand. Judging demand is tough enough, but when investors can’t be secure about how likely the debt they are buying into can be repaid, they will pass on the opportunity.

It’s no different with jobs. When even a thriving business can’t be sure if its customers will really be buying in six months, there’s little chance it will hire or expand.

When the wheels come off and people lose their jobs or their houses, that’s a fouled up situation, but in the course of an economic contraction, it’s also normal.