Nearly six months after the onset of the hysteria that gripped the financial markets this past fall, we can begin to look more clearly at the wreckage left behind when a half dozen of the world’s financial institutions went belly up within a couple of weeks. Through TARP and TALF and ARRA (aka the Stimulus) and a whole bunch of money used to keep AIG afloat, the federal government has gained a disproportionate amount of ownership in the formerly free market. What would be a shame is if out of all this investment, the assets that started all the problems – residential mortgages – didn’t end up in the government’s hands to pay back the investment.

TARP, in case you don’t remember, stands for Troubled Asset Relief Program. The benefit of this extraordinary government intervention in the free market was supposed to be the removal of the so-called ‘toxic assets’ from the balance sheets of the banks. One of the more persuasive arguments made at the time of the debate over TARP was that Japan had failed to provide such relief in the late 1990’s and thus prolonged their credit problem into the ‘lost decade’ recession.

The asset relief was to begin the recovery of the banks’ stability and presage more normalized lending. What Fed Chair Bernanke discovered almost immediately was that the unwinding of the balance sheets would delay action with TARP for six months, time he didn’t feel the economy had. So his solution was to infuse capital the way the markets do it, by equity investing, in this case buying preferred stock. But the long term solution must still be getting the bad assets off bank balance sheets.

Mortgage backed securities (MBS) are kind of the poster child for this financial crisis. The common wisdom on the problem with MBS is that the underlying assets, residential mortgages, are so under water because of the derivative reselling of bad loans on houses whose value is plummeting. This, however, is not actually accurate. Let’s look at the problem from both sides: plummeting values and inability to pay.

Both sides of the problem are somewhat related, in that the magnitude of the problem is being overstated compared to the number of loans actually in default. At last report, the delinquency rates on residential mortgages was climbing, but the number of loans that were current was still above 91%. That level of regular repayment reinforces the argument that declining values don’t cause defaults for most homeowners. The recession is absolutely having a negative impact on the number of people who can no longer make their house payments. That’s why foreclosures are up, and why the number of delinquent mortgages climbed to historically high levels at more than 8%. If delinquent loans make up 10% of the total pool (and that’s possible if recovery stretches out another year or more), that level would be extremely high and rare.

Why these ratios are important is that they contrast sharply with the discounts at which most of the MBS traded hands last fall. When Lehman Brothers was going under, it was forced to sell securities as low as 18 cents on the dollar to meet unprecedented redemption requests. That may have been the low water mark, but even conservative estimates of the diluted value of the MBS market are at 25% to 30%, meaning that the securities are being discounted by a factor or six or seven times the actual default rate. The perception is that the sub-prime mortgages (which are 90% current at the moment) are failing and the securities based on them are worthless. The reality is that they are only worth less than at their peak, not worthless.

If the Treasury can see fit to make its acquisitions be of existing and new MBS product, it could actually initiate an increase, maybe a dramatic one, in the value of those securities. This would have an immediate positive impact on bank balance sheets, as well as on shareholder values. Even if the federal intervention did not goose the confidence in MBS, the government would still then hold securities that over time would actually pay back, and the TARP investments would turn a profit. This is what ultimately happened with the Resolute Trust Corp., a government agency that bought property and oversaw the recovery from the Savings and Loan problems in the late 1980’s. Such an eventuality would mean that the trillions spent (or misspent if you’re Republican) would be paid back by the recovery in housing that will occur at some point, rather than being a burden on our children.

If you need further convincing, look to the markets. As of this writing, there are entrepreneurial financial wizards beginning to talk to the long-term investment managers about new products that will be based on the purchase of discounted MBS and ABS tranches from bank balance sheets. These smart folks have done the math and realize that taking a chunk of some discounted MBS off the bank’s hands at 30% of the value will pay off handsomely over time as the underlying mortgages are steadily paid off, even if the delinquency rate were to grow to 80%, an astronomical figure. What these folks are looking for are investors with a long enough horizon to wait until the market recovers and house values climb again to start booking their double-digit returns.

Government investment in banks and investment houses is contrary to the free market, and distasteful to most Americans. As long as the government is doing the distasteful, it should do so in a way that profits the taxpayer directly, rather than let some enterprising financiers or the banks themselves, take a windfall on the other side.

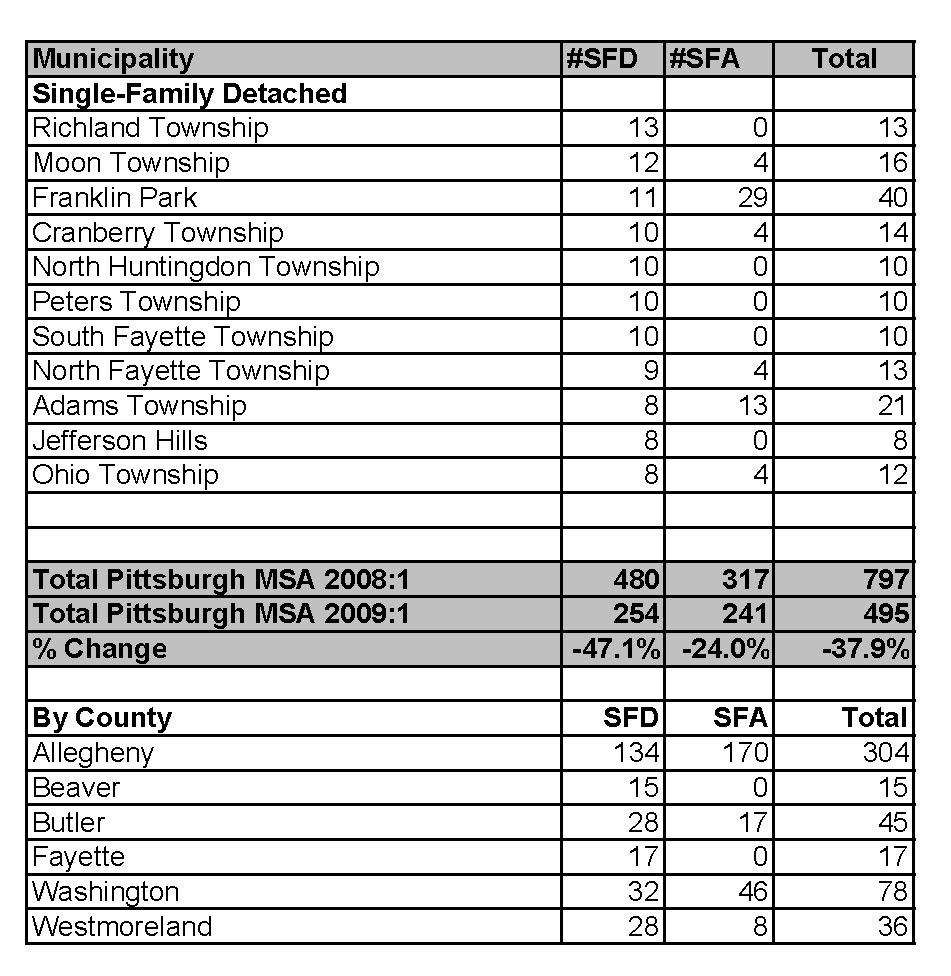

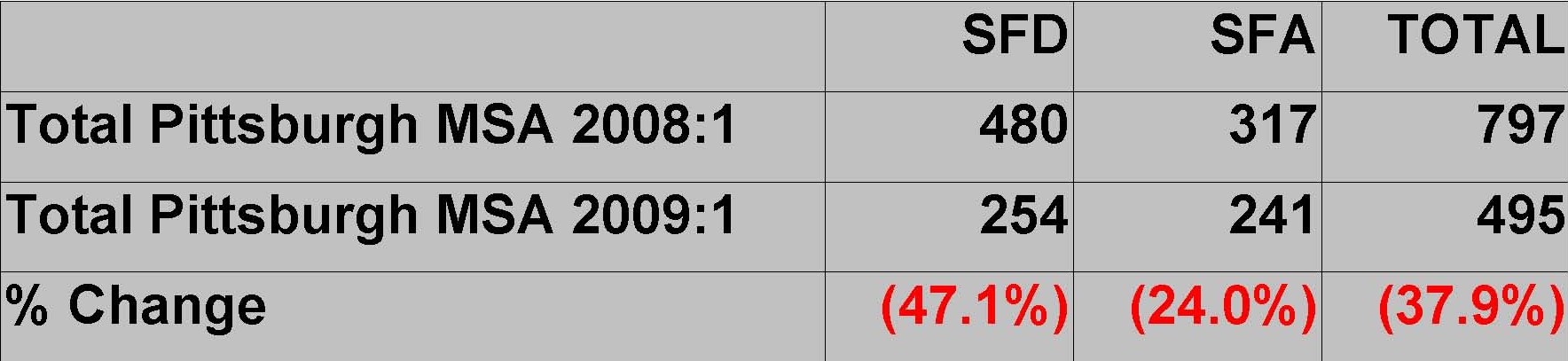

March permits were about twice January and February numbers but there isn’t a lot of cheer from that. Although Pittsburgh’s economy appears to be outpacing the national conditions, the uncertainty translated to almost no demand in the first couple of months. Because there are so few spec builders in the region, slow demand means slow starts. Tall Timber Group is forecasting a pickup throughout the remainder of 2009, but expects permits for new construction will remain well below normal levels until mid-2010 or later.

March permits were about twice January and February numbers but there isn’t a lot of cheer from that. Although Pittsburgh’s economy appears to be outpacing the national conditions, the uncertainty translated to almost no demand in the first couple of months. Because there are so few spec builders in the region, slow demand means slow starts. Tall Timber Group is forecasting a pickup throughout the remainder of 2009, but expects permits for new construction will remain well below normal levels until mid-2010 or later.